How Rent-To-Own Homes Work In The United Kingdom

Introduction to Rent-To-Own Homes

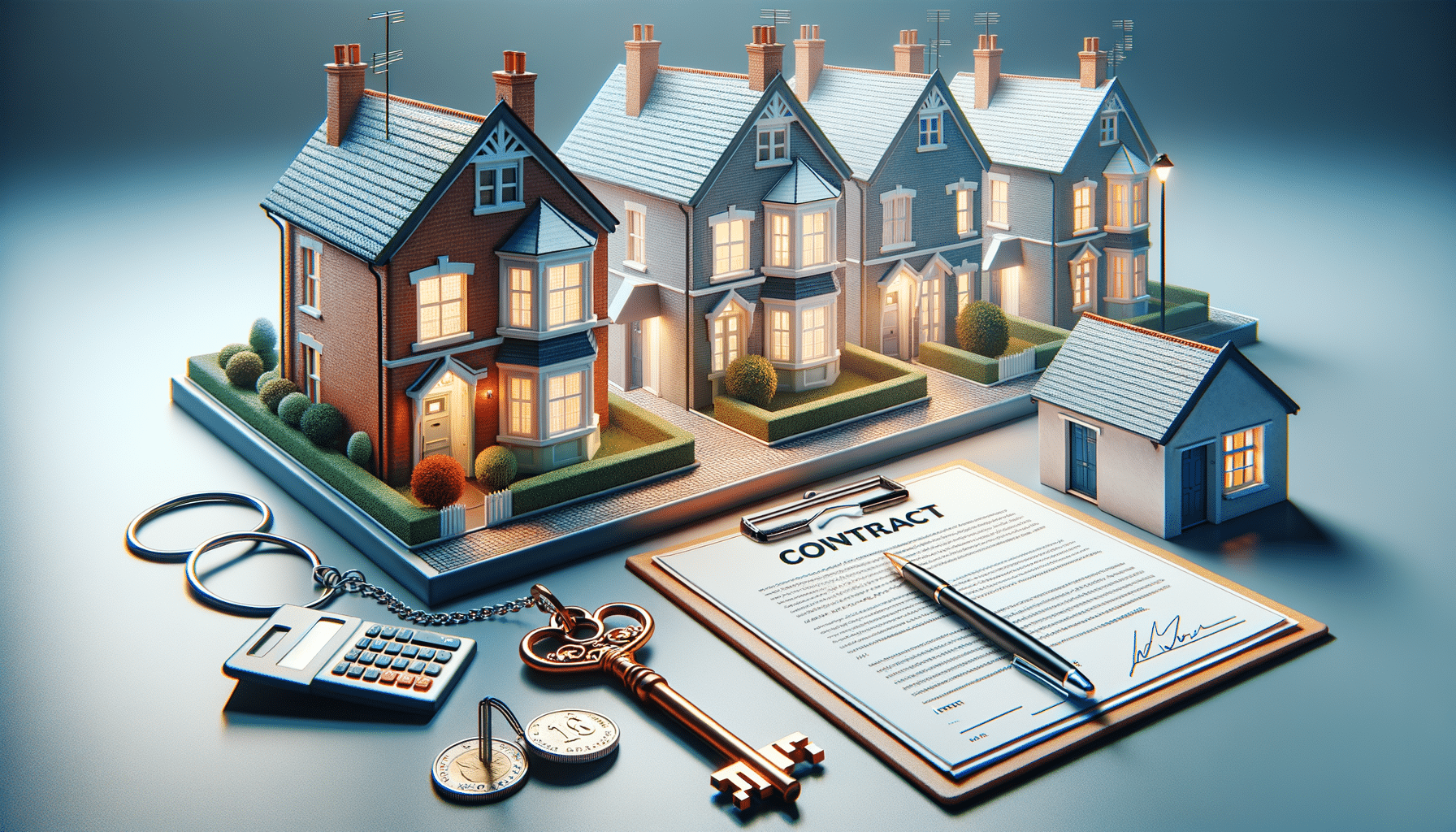

In the quest for homeownership, many individuals in the United Kingdom face the challenge of securing a mortgage. High property prices and stringent lending criteria can make this dream seem elusive. However, the rent-to-own model offers a viable alternative for those who are not yet ready for a traditional mortgage. This approach allows tenants to rent a property with the option to purchase it later, providing a pathway to homeownership while building financial stability.

Rent-to-own agreements typically involve a lease period during which the tenant pays rent, with a portion of each payment contributing towards a future down payment. This model can be particularly beneficial for individuals who need time to improve their credit score or save for a deposit. By understanding the mechanics of rent-to-own homes, prospective buyers can make informed decisions about their housing future.

The Mechanics of Rent-To-Own Agreements

Rent-to-own agreements in the UK are structured to benefit both the tenant and the landlord. These contracts usually consist of two main components: the rental agreement and the option to purchase. The rental agreement outlines the terms and conditions of the lease, including the duration, monthly rent, and maintenance responsibilities. The option to purchase grants the tenant the right, but not the obligation, to buy the property at a predetermined price after the lease period.

One of the key advantages of this model is the ability to lock in a purchase price at the start of the agreement. This can be particularly advantageous in a rising market where property values are expected to increase. Additionally, tenants can use the lease period to assess the property and neighborhood, ensuring it meets their long-term needs before committing to a purchase.

However, it is crucial to carefully review the terms of the agreement, as some contracts may include non-refundable option fees or penalties for not exercising the purchase option. Prospective tenants should seek legal advice to fully understand their rights and obligations under the agreement.

Benefits of Rent-To-Own Homes

The rent-to-own model offers several benefits for aspiring homeowners in the UK. Firstly, it provides an opportunity to build equity while renting. A portion of the monthly rent is typically credited towards the purchase price, allowing tenants to gradually accumulate a down payment. This can be particularly beneficial for individuals who struggle to save while paying rent and other living expenses.

Secondly, rent-to-own agreements offer flexibility and time to improve financial standing. Tenants can use the lease period to enhance their credit score, pay off existing debts, and secure a better financial position for obtaining a mortgage in the future. This model also allows tenants to experience living in the property and community before making a long-term commitment, reducing the risk of buyer’s remorse.

Moreover, rent-to-own homes can provide stability in a competitive rental market. With the option to purchase, tenants can avoid the uncertainty of rising rents and potential eviction, offering peace of mind and a sense of security.

Challenges and Considerations

While rent-to-own homes offer numerous advantages, there are also challenges and considerations to keep in mind. One potential drawback is the risk of forfeiting the option fee and any rent credits if the tenant decides not to purchase the property. It is essential to thoroughly evaluate the terms of the agreement and ensure it aligns with personal financial goals and circumstances.

Additionally, tenants are often responsible for property maintenance and repairs during the lease period, which can be a significant financial burden. It is crucial to budget for these expenses and factor them into the overall cost of the agreement.

Another consideration is the potential for property value fluctuations. If the market declines, tenants may find themselves locked into a purchase price that exceeds the property’s current value. Conversely, if property values rise significantly, the agreed purchase price may be advantageous.

Conclusion: Is Rent-To-Own Right for You?

Rent-to-own homes present a compelling option for individuals in the UK seeking a pathway to homeownership without the immediate need for a mortgage. This model offers the dual benefits of renting and gradually building towards ownership, making it an attractive choice for those looking to improve their financial standing or test the waters of homeownership.

However, it is essential to approach rent-to-own agreements with careful consideration and due diligence. Prospective tenants should assess their financial situation, understand the terms of the agreement, and seek professional advice to ensure it aligns with their long-term goals. By weighing the benefits and challenges, individuals can make informed decisions about whether rent-to-own is the right choice for their journey towards owning a home.