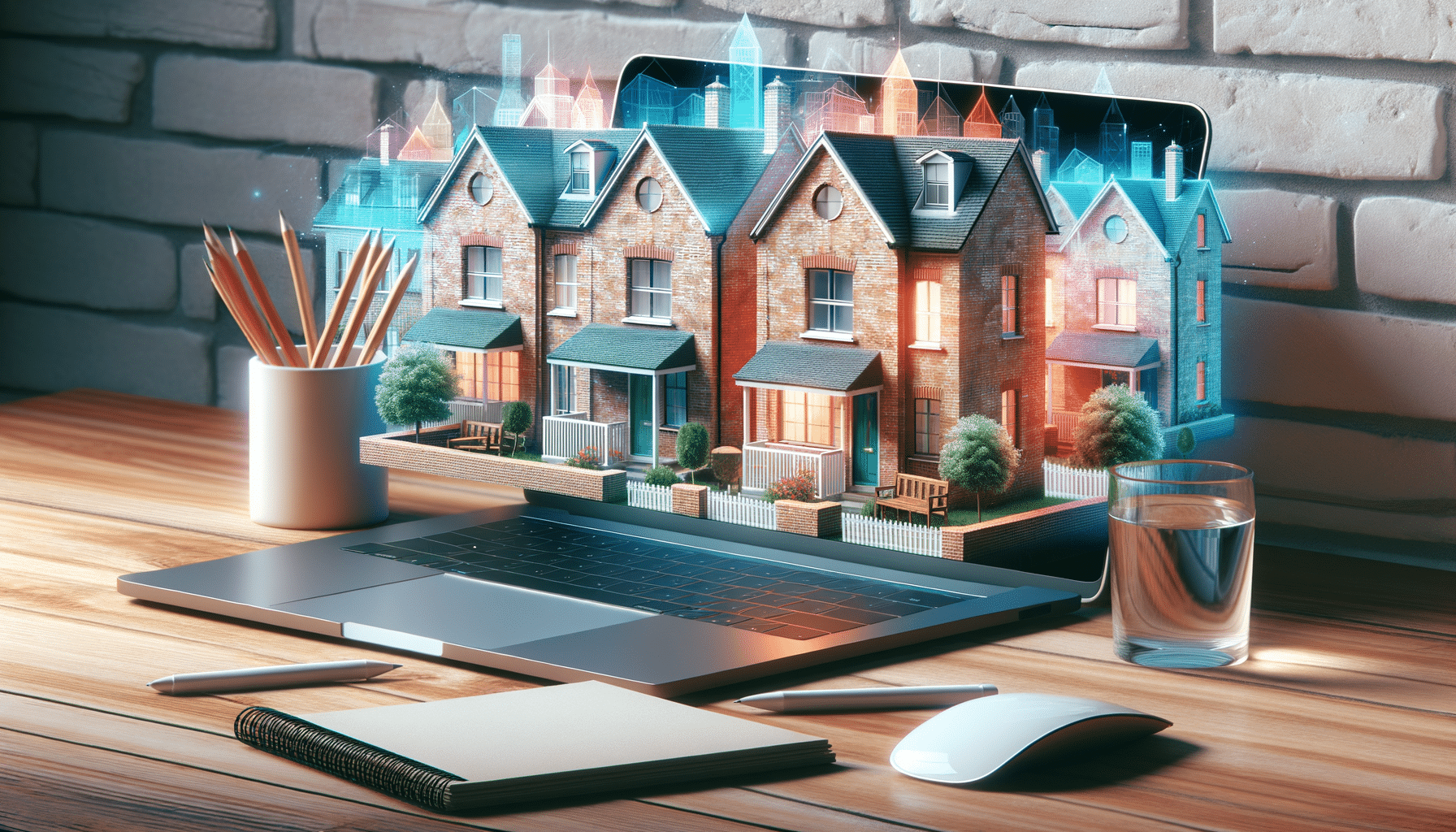

How Rent-To-Own Homes Work In The United Kingdom

Introduction to Rent-to-Own Homes in the UK

Rent-to-own homes present a compelling alternative for individuals in the United Kingdom who aspire to own a home but are not yet financially prepared to secure a mortgage. This innovative housing model allows tenants to reside in a property while gradually saving towards purchasing it in the future. The flexibility and potential of rent-to-own arrangements make them an attractive option for many prospective homeowners.

In this article, we will explore the intricacies of rent-to-own homes, focusing on how they operate within the UK housing market. We will delve into the benefits and challenges associated with this model, providing a comprehensive understanding for anyone considering this path to homeownership.

Understanding the Rent-to-Own Process

The rent-to-own process typically involves two main components: a rental agreement and an option to purchase. During the rental period, tenants pay rent, with a portion of this payment often allocated towards a future down payment on the property. This arrangement allows potential buyers to build equity over time while living in the home they intend to purchase.

Key aspects of the rent-to-own process include:

- Option Fee: An upfront fee paid by the tenant to secure the option to purchase the property at a later date. This fee is usually non-refundable but can be credited towards the purchase price.

- Purchase Price: The price at which the tenant can buy the home, often agreed upon at the start of the rental agreement.

- Lease Term: The duration of the rental period, typically ranging from one to three years, during which the tenant can exercise the option to purchase.

This model offers a unique opportunity for individuals who may not currently qualify for a mortgage to work towards homeownership while living in their desired property.

Benefits of Rent-to-Own Homes

Rent-to-own homes offer several advantages that make them appealing to prospective homeowners. One of the primary benefits is the ability to lock in a purchase price at the beginning of the rental agreement. This can be particularly advantageous in a rising property market, as it protects the tenant from future price increases.

Other notable benefits include:

- Time to Improve Credit: Tenants have the opportunity to improve their credit scores during the rental period, increasing their chances of securing a mortgage when it comes time to purchase the home.

- Test Living Conditions: Rent-to-own agreements allow tenants to experience living in the property and neighborhood before committing to a purchase, ensuring it meets their long-term needs and preferences.

- Building Equity: By allocating a portion of the rent towards the purchase price, tenants can gradually build equity in the property.

These benefits make rent-to-own homes a viable option for individuals seeking a flexible path to homeownership.

Challenges and Considerations

While rent-to-own homes offer numerous advantages, there are also challenges and considerations to be aware of. One potential drawback is the non-refundable nature of the option fee. If the tenant decides not to purchase the property or is unable to secure financing, this fee may be forfeited.

Additional challenges include:

- Market Fluctuations: If property values decrease, tenants may find themselves locked into a purchase price higher than the current market value.

- Maintenance Responsibilities: Rent-to-own agreements often require tenants to take on maintenance and repair responsibilities, which can add unexpected costs.

- Financing Risks: There is no guarantee that tenants will qualify for a mortgage at the end of the lease term, which could jeopardize their ability to purchase the home.

Prospective tenants should carefully evaluate these factors and seek professional advice to ensure that a rent-to-own arrangement aligns with their financial goals and circumstances.

Conclusion: Is Rent-to-Own Right for You?

Rent-to-own homes offer a unique pathway to homeownership, particularly for individuals who may not be ready to secure a traditional mortgage. This model provides the opportunity to live in and eventually purchase a home while working towards financial stability.

However, it is essential to weigh the benefits against the potential challenges and carefully assess personal financial situations before committing to a rent-to-own agreement. For those who are prepared to navigate the complexities and uncertainties, rent-to-own homes can be a stepping stone towards achieving the dream of homeownership in the UK.